How To Save For A Year Long Trip Around The World Using A Simple App

This post is in partnership with Wealthfront

I traveled the world for a year without working

Now, you’re probably wondering how this was possible.

How could I live, let alone travel without working?

It’s actually pretty simple. I spent two years saving up to make this dream a reality and it’s the best investment I’ve ever made in myself.

Upon graduating college, I knew that I wanted to spend a year traveling the world. Society told me that I had to wait until retirement to make this happen, but that didn’t make sense to me. What if I never made it to retirement? Better yet, what if I just didn’t want to wait until then?

With all of this in mind, I began researching and planning to take a year off. I structured my entire life around this goal because I knew I would have to make some major sacrifices to make it happen. I had a big girl job and I was earning more money, but I didn’t want that to distract me from my long-term goal. Here’s how I saved:

-

Got A Roommate – While my peers were buying brand new cars and swanky apartments, I got a roommate and held it down in my 2003 Suzuki. Getting a roommate put an extra $600 in my pocket to either save or use towards another expense.

-

No Shopping – This blog started out as a fashion AND travel blog, but I quickly realised I would have to drop my shopping habit if I wanted to travel the world. It was an easy decision since I knew the long-term benefits of travel far-outweighed that of a trendy skirt.

-

Create A Travel Savings Account – Early on, I knew that I would have to save a large portion of my money. I didn’t want to get into the habit of spending more just because I was earning more. For the most part, any extra money I earned was be deposited into a savings account.

-

Change My Mindset – I would think of every purchase in terms of a potential travel cost. If I wanted a $75 pair of shoes, I imagined how that could pay for several nights of accommodation. Anytime I thought of paying for an expensive electronic, I would imagine the plane ticket I could buy with that money.

-

Limit My ‘Wants’ – Wants vs. Needs. I prioritised purchases that needed to be made and limited things that I wanted like coffee, nails, gym plans, expensive meals, cable, and so much more.

Needless to say, I kept my eyes on the prize. Two years later and I’m still going. It hasn’t always been easy though. I didn’t know if I should be saving more or less. I didn’t know if my savings would actually last me an entire year. More importantly, I didn’t know how to analyse the long term impact this goal would have on my overall financial health. Ultimately, I was able to meet my goal, but I do wish I would have had more financial guidance along the way.

These days, I receive a-lot of questions from people who want to take a long term vacation – whether that be three months or two years. They want to know how they can save and plan for a huge financial goal like this. While every situation is different, the key is to establish a financial plan. If you have no idea where to start, I highly recommend checking out Wealthfront to find out what works best for you.

What is Weatlhfront?

It’s an automated financial planning app and it’s completely free. You can receive advice on anything from taking time off to planning for retirement.

After entering the required information in the app, you’ll receive automated advice and assistance to help you start a savings or investment plan. You’ve basically got a financial advisor in the palm of your hands. As a millennial, this is a-lot less intimidating than seeking out(and paying for) an advisor.

How Does Weatlhfront Work?

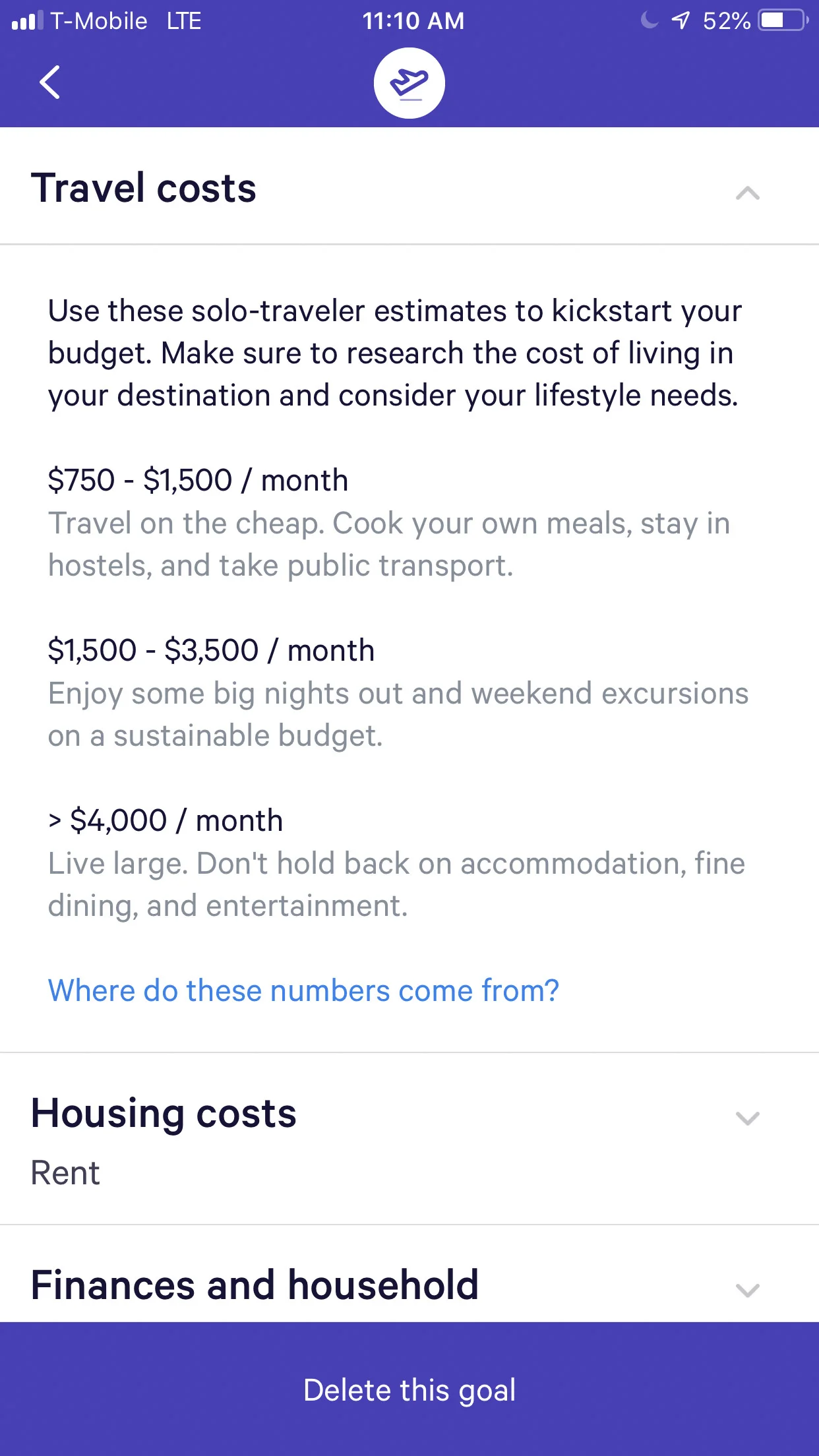

You’ll enter your financial information and goals into the app. If you want to travel for a month or a year, the app will let you know what’s possible based on your current income and expenses. Based on research, it will predict how much you need to save and how it will affect your finances in the long term. It simplifies the entire process.

For example, if you plan to travel the world for a year on a budget – Wealthfront advises you to save up to $1500 per month of travel. From personal experience, I can tell you that this is correct. I saved this exact amount to use during my year long trip. You can adjust the amount based on your lifestyle or level of comfort. You’ll discover how things like working remotely, renting your apartment on Airbnb, and even traveling to a different destination will impact the feasibility of your trip.

The app will tell you if your goal is possible, a stretch, or simply unaffordable with your income and other costs in mind. They account for recurring costs like student loan payments, taxes, rental costs and more. You have the ability to add goals like saving for college or taking parental leave. It informs how every decision will affect your retirement plans along with any other goals you have. Be prepared – the app keeps it pretty real.

It’s an interesting way to look at the big picture and see how(if) everything fits together.

How I’m Using Weatlhfront Now

I’m no longer saving up for a long term trip and I’m earning income now, so my goals have changed. I work online, but I know that this also holds a bit of uncertainty. I love travel, but it’s important for me to prioritise other goals as well. This whole experience has broadened my perspective and taught me what I’m capable of. I want to continue paying off my student loans and be financially prepared when I’m ready to purchase a home, donate money to causes I support, start a new business venture, or anything else I have in mind!

One of my biggest goals in 2019 is to start investing. At the moment, I don’t know where to start. However, I’m confident that Weatlhfront will be a useful service throughout my journey.

Download the app here to start saving for your journey and keep an eye out for my next blog post where I’ll continue sharing my experience with the Wealthfront.

If you knew it was possible,

where would you go?

PIN ME! ⇣⇣⇣

SHARING IS CARING! IF YOU FOUND THIS HELPFUL, SHARING OR PINNING IS ONE OF THE GREATEST WAYS YOU CAN SHOW SUPPORT! THANK YOU!

You Might Also Enjoy:

What steps have you taken to reach major financial goals in your life?

Hey, I'm Ciara. I’m a global citizen and lover of travel. Want to know more?

Things you need to know before visiting Tulum

25 TIPS TO STAY SAFE AS A SOLO FEMALE

Things you need to know before visiting Tulum

WANNA BE PEN PALS?

Sign up to stay current on all my latest tips, tricks, photos, and lists.